A Maryland lawmaker wants to increase taxes to invest in reparations efforts.

Sen. Jill Carter, D-Baltimore City, sponsored the Maryland Reparations Act of 2024, calling for a “certain amount of revenue from the State individual income tax and Maryland estate tax be distributed to the Community Reinvestment and Repair Fund.”

Maryland established the Community Reinvestment and Repair Fund in 2023 to provide funds to organizations that would serve the individuals “most impacted by disproportionate enforcement of cannabis prohibition before July 1, 2022.” Carter’s bill would allocate more funding to the Community Reinvestment and Repair Fund by changing the state’s tax code.

Per state law, the money would service low-income individuals and “disproportionately impacted areas.”

Sen. Jill Carter, D-Baltimore City, sponsored the Maryland Reparations Act of 2024. (YouTube screenshot)

“We are just in the beginning stages of our process of legalizing marijuana and we have made some great strides, like when we created the Community Reinvestment and Repair Fund, which is designed to put money back into, to prioritize communities of color that have most been negatively impacted by the war on drugs that unfortunately was a war mainly on poor and black people,” Sen. Carter told the Senate Budget and Taxation Committee on February 14th when she introduced the bill.

The money will come from an “additional State individual income tax rate on the net capital gains of individuals.”

“What this bill would do would help to infuse that fund with more money, and it’s not too much of an ask, because in doing the research for this bill, I learned we use the lowest taxation rate of any state in the country that has legalized marijuana,” she said.

Furthermore, the bill seeks to alter the “rates and rate brackets under the State income tax on certain income of individuals” and increase the rate of sales and use tax for cannabis from 9% to 14%.

According to a local Fox affiliate, Carter wants the bill to be acted on immediately.

According to a local Fox affiliate, Sen. Jill Carter, D-Baltimore City, wants lawmakers to act on the Maryland Reparations Act of 2024 bill immediately. (AP Photo/Brian Witte, File)

REPARATIONS MAKE INCREASINGLY LESS SENSE AS AMERICA GROWS MORE DIVERSE, THINK TANK REPORT ARGUES

Carter’s office did not immediately respond to a request from Fox News Digital for comment.

Some advocates of reparations have called for institutions and government officials to disseminate up to billions of dollars as a recourse for descendants of slaves due to unpaid labor during slavery in the U.S.

Furthermore, municipalities across the country have established task forces to examine U.S. historical ties to slavery, including Boston, San Francisco and New York.

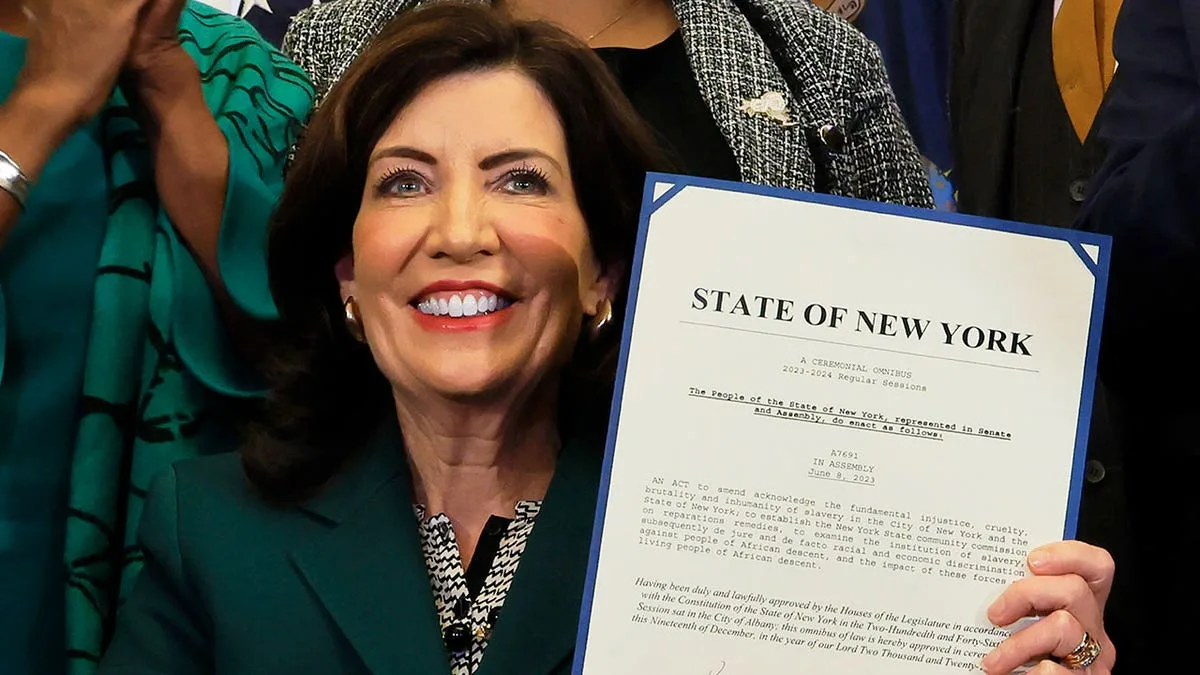

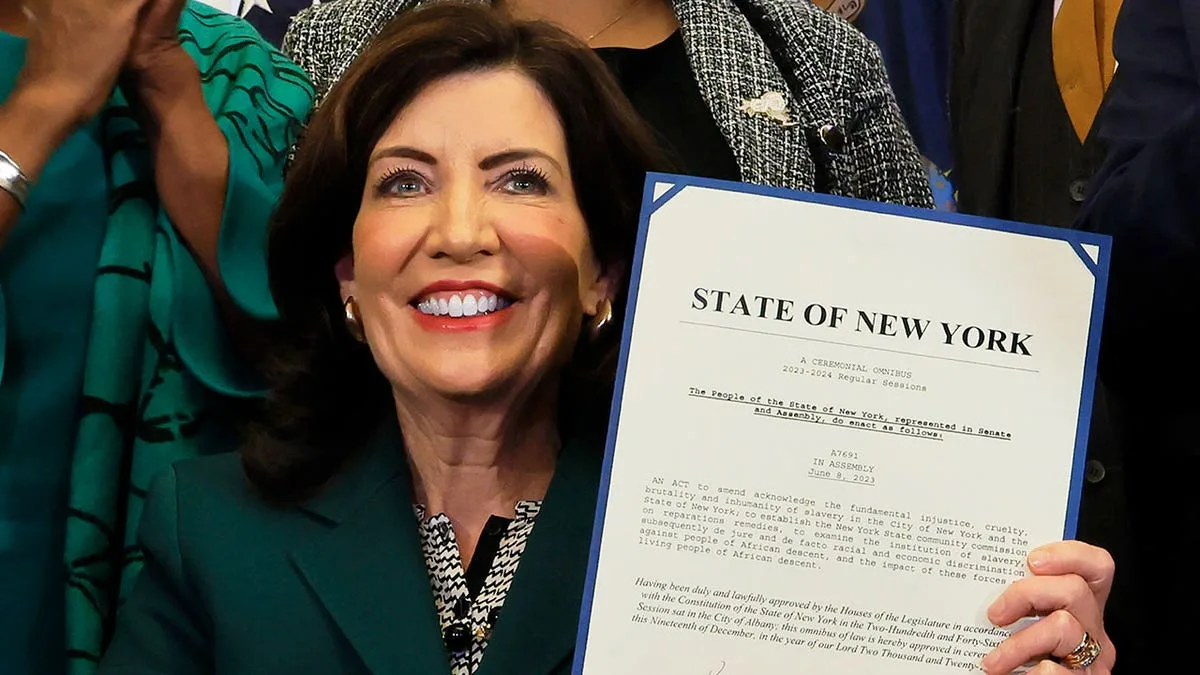

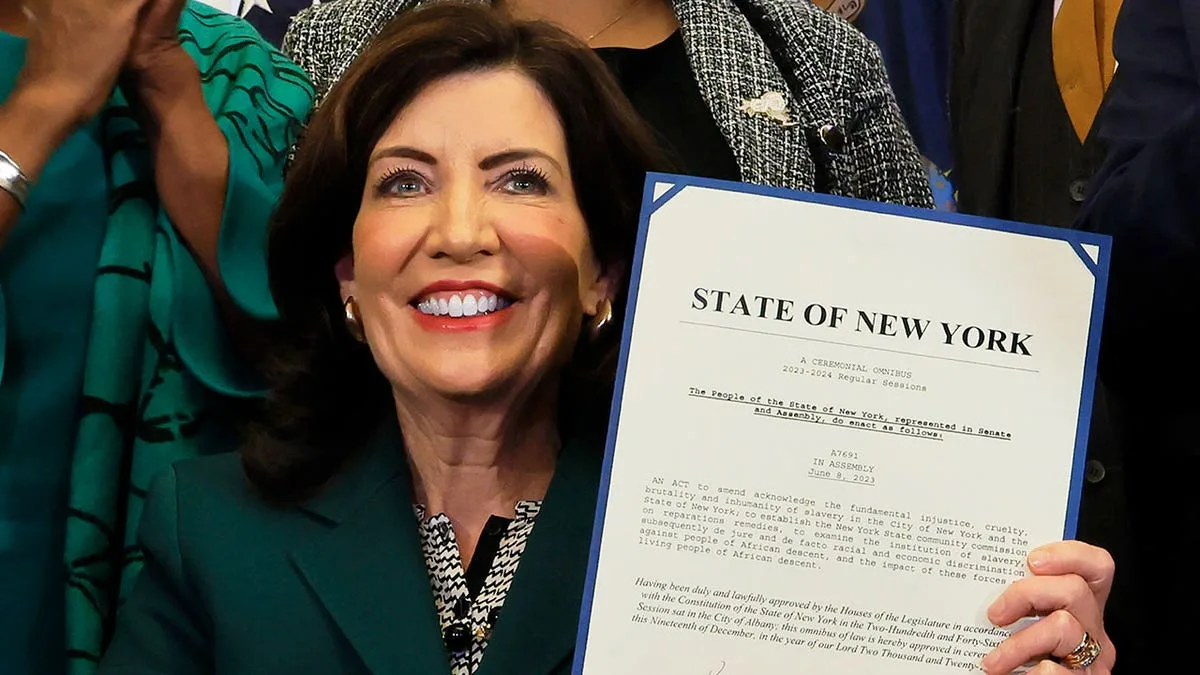

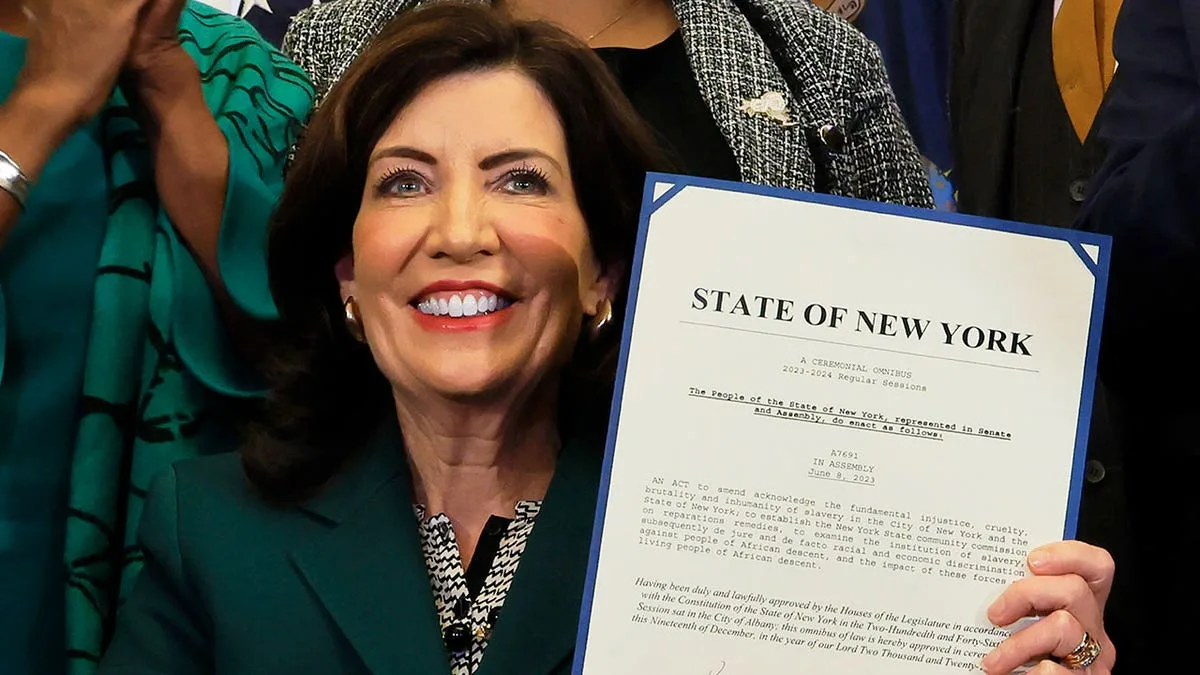

New York Gov. Kathy Hochul holds up signed legislation creating a commission for the study of reparations in New York on December 19, 2023 in New York City. Gov. (Photo by Michael M. Santiago/Getty Images) (Michael M. Santiago/Getty Images)

CLICK HERE TO GET THE FOX NEWS APP

Evanston, Illinois, was the first city in the nation to pass a reparations plan, pledging $10 million over 10 years to Black residents.

The practice is even being considered at the federal level, with one lawmaker having sponsored a resolution that seeks to establish the U.S. has a “legal and moral obligation” to institute reparations.