The modest Cape-style homes on a side street in Beverly are the kind of starter homes with manicured lawns that could accommodate young families looking to settle down in a seaside community rich with New England history. But deep in their foundation, there remains a chilling vestige of America’s racist past that, if not legal today, still lives on in government property records.

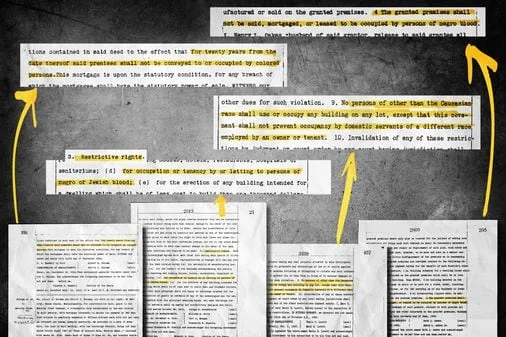

They are deed restrictions, racial covenants that for decades were used to keep Black and Hispanic households, sometimes Jewish or other ethnicities such as Armenians, from living there. A recent research project found hundreds of examples of them in the Southern Essex Registry of Deeds in Salem. They contain language that, for example, prohibited the properties from being sold or conveyed to, or even occupied by, “no person of other than the Caucasian race.”

Such covenants were discontinued in the 1960s, and the language that remains in deeds today is legally void. Nonetheless, the racist practice has left a lasting imprint, playing a large part in why so much of the state is segregated along racial lines, with economic disparities that still resonate.

Now, housing and civil rights advocates say, the covenants and similar policies that historically discriminated against certain groups of people can be turned on their ear, and used as a tool to close a wealth gap drawn along those same racial lines. Advocates are increasingly citing the existence of these covenants, for instance, as legal and political justification as they push banks to create more specialized loans with better interest rates specifically for people of color to buy their first home, or for start-up grants solely for Black and Latino entrepreneurs looking to open a business.

Racial groups or geographic areas that could show they have suffered from a pattern of racist policies, such as the use of covenants, would qualify under what are known as special purpose credit programs.

“It’s really about seeing these things, so that we can continue to address where we are today,” said Kenann McKenzie-DeFranza, a professor at Gordon College and president of the North Shore chapter of the NAACP, which cosponsored the research. “It’s to remind us that some of this is not so far gone, it’s not so hidden, it’s not so long ago that we can forget about it.”

The research effort, which involved the University of Minnesota’s Mapping Prejudice project, found more than 560 deeds with restrictive covenants in the suburbs north of Boston. And they were located in some of the whitest communities in Massachusetts. In the town of Lynnfield, where most of them were found, white people make up 88 percent of the population — 17 times the rate of any other race. Danvers is 87 percent white. Nahant is 94 percent.

The disparities are not just in the North Shore. The rate of homeownership for white families in New England is twice that of Black households, and the difference is the same in Boston.

Homeownership remains one of the primary drivers of wealth, but obstacles such as racial covenants and discriminatory lending practices such as redlining have prevented many people of color from buying homes. The result is a racial wealth gap that shows white Bostonians having a net worth that is 19 times higher than Black residents.

Jean Michael Fana, education and advocacy manager for Harborlight Homes, which partnered in the deed research, said that people today, particularly in the Northeast, tend to think of racial covenants as relics of southern slavery. But the project showed that as recently as a few decades ago, they contributed to the segregated power structures in Massachusetts, playing the deciding factor in where people could and could not buy a home; some of the covenants were written as recently as the 1950s.

Now, he said, there should be a concerted effort to target those excluded groups with policies that could help families build and accrue wealth.

“When we talk about these inclusionary programs, what we’re saying is, right now someone is on an unfair, lower playing field, because of something that was out of their control,” he said. “When we want to bring these inclusionary polices in, it’s to bring them to a level where everyone else is already at.”

Special purpose credit programs have been available since 1976under the federal Equal Credit Opportunity Act, but housing advocates say they have taken on a new significance — and there is greater awareness of them — in the post-2020 racial reckoning that followed George Floyd’s murder by Minneapolis police.

In December, a report by the Partnership for Financial Equity and MassHousing laid out the history of such programs and the few examples of their use in Massachusetts, aiming to promote them to lenders in the area as a “key tool for greater equity.” The report points to guidance that federal regulators have issued since 2020 as interest in the programs has grown.

Recent regulations allow government agencies to legally sponsor special purpose credit programs targeting a specific group, if the government can show it was historically involved in a discriminatory practice that affected that group. Last year, for instance, the state of Washington became the first in the nation to enact a law to allow for targeting down-payment assistance specifically to racial groups who were excluded by government-sanctioned racial covenants.

The law, known as the Covenant Homeownership Act, allows the state to first examine who would qualify for homebuyer assistance. Then, the state would enact a $100 fee for every new real-estate transaction that would be used to directly fund the special purpose credit program.

Chrystal Kornegay, CEO of MassHousing, a quasi-state agency that supports the acquisition and development of affordable housing units, said the primary way to help people build assets and close the wealth gap is to help them buy their first home. And so, she said, special purpose credit programs could serve as critical support for people who have historically been discriminated against — either through redlining or racial covenants or other policies that prevented them from buying their first home.

The programs could help people qualify for a loan, or build up a sufficient down payment, in ways that otherwise would not have been possible, she said.

“Special purpose credit programs promote equity and opportunity,” Kornegay said, “by allowing lenders to respond directly to historical discrimination and disinvestment.”

Last year, the Federal Home Loan Bank Boston launched one of the few special purpose credit programs in the state, a $2.5 million pilot called Lift Up Homeownership that provides down payment and closing cost assistance to low-income people of color purchasing their first home anywhere in New England.

By the end of 2023, the program had assisted 51 households, each with an average household income of $92,575, roughly around 86 percent of the area median income. The average grant for down payment assistance was $49,020.

Kenneth Willis, the bank’s senior vice president and director of housing and community investment, said the program is an opportunity to invest in communities that have historically been neglected in the lending industry.

Willis said the bank worked with researchers at Harvard’s Joint Center for Housing Studies to examine racial home-ownership disparities, and he found the numbers “staggering.” Only 36 percent of Black households in New England own their own home, compared to 72 percent of white households. The rate is lower than the national average. Meanwhile, research by Partnership for Financial Equity found that Black borrowers in Massachusetts were denied mortgages at twice the rate of white borrowers: in Boston, it was nearly three times the rate.

Willis said he worked with legal counsel to develop a structure that would comply with the terms set out in the Equal Credit Opportunity Act to support disenfranchised groups, targeting Black and Latino families.

“We started saying, ‘what can we do to help and play our part in helping to close the racial wealth gap,’ and that was the genesis of getting on this,” he said. “It was a reckoning, the fact that certain groups in this country have been treated differently than others.”

This story was produced by the Globe’s Money, Power, and Inequality team, which covers the racial wealth gap in Greater Boston. You can sign up for the newsletter here.

Milton J. Valencia can be reached at milton.valencia@globe.com. Follow him @miltonvalencia and on Instagram @miltonvalencia617.