When former attorney Syovata Edari decided to take her chocolate-making hobby full time, it took everything she had to start her businesses.

Like many business owners of color, Edari struggled to secure financing when she scaled-up from her mom’s kitchen to a shared kitchen and then to a brick-and-mortar store.

Now the owner of the award-winning CocoVaa Chocolatier in Madison, Edari said she cashed out her retirement fund and her mom took out a second mortgage on their family home just to get a store front.

Stay informed on the latest news

Sign up for WPR’s email newsletter.

“A lot of people don’t understand that when you go into that sort of situation, you’re building it mostly at your expense,” she said. “When you face historical barriers to getting financing (and) being valued by potential investors, it’s really tough.”

Edari’s experience is reflected in a new report from the University of Wisconsin–Extension. It found that while the number of Wisconsin businesses owned by people of color has grown significantly since the late 1990s, they’re still underrepresented when compared to how many people of color live in the state.

In all, Wisconsin has more than 48,000 businesses owned by people of color, employing nearly 55,000 workers and contributing over $1.6 billion in payroll.

“We might assume that they are concentrated in our urban areas, and that’s certainly true to some extent,” said Tessa Conroy, the report’s lead author and an associate professor of agricultural and applied economics at UW-Madison. “But we have business owners of color all throughout the state geographically and they’re operating in all sectors of the economy.”

From 1997 to 2012, Native American businesses grew by 33 percent, Asian businesses more than doubled, Latino-owned businesses almost tripled and Black-owned businesses roughly quadrupled, the report said. Over the same period, non-minority-owned businesses grew by 10.7 percent.

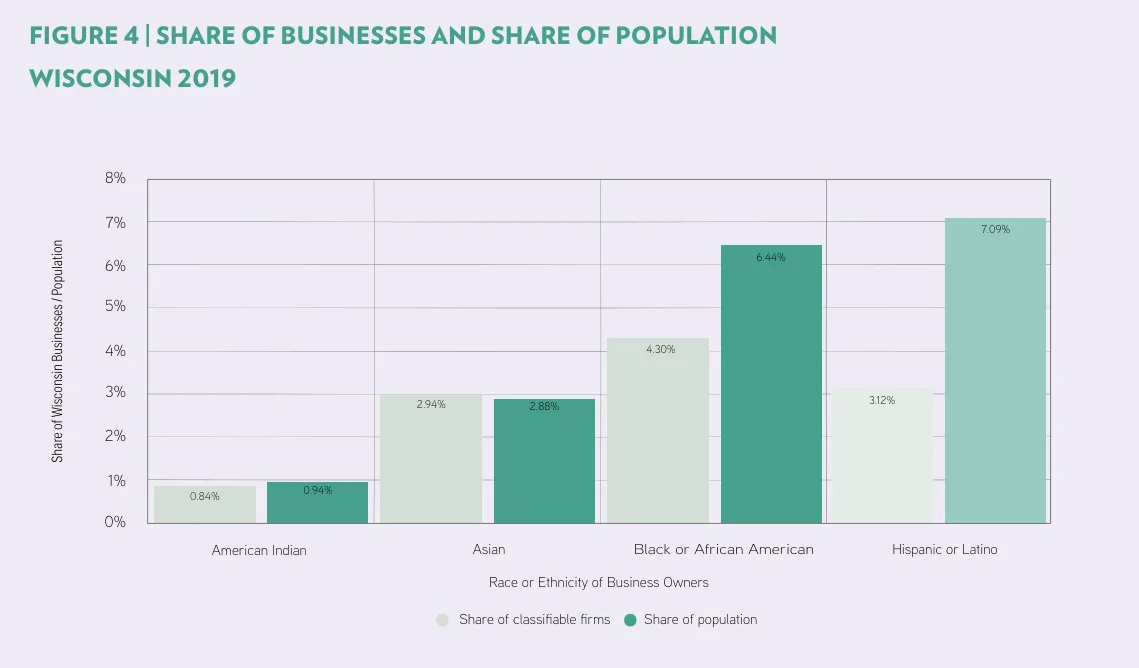

Even with that growth, diverse businesses remain underrepresented in the state’s business community. According to the study, businesses owned by people of color made up almost 11 percent of businesses in 2019, but people of color made up about 19 percent of the state’s population.

Wisconsin ranked last out of all 50 states for the rate of business ownership among minorities, the report said.

Those disparities are more pronounced among certain ethnicities in Wisconsin. Latinos own 3.12 percent of businesses but make up 7.09 percent of the population. And African Americans own 4.3 percent of businesses and make up 6.44 percent of the population.

The study said communities of color come up against a variety of obstacles like a lack of financing, lending discrimination and less exposure to business development resources leading to weaker support networks.

“Access to capital is really big,” Conroy said. “That can make it more difficult for people of color to start and operate their businesses.”

Makélélésho African Shop in downtown Green Bay also had to jump through hoops to get their business off the ground, according to store co-owner Quench Mufano.

He said it took him and a business partner two years to make their dream of opening an African grocery store a reality.

“The problem was money — raising money to start this kind of business because most of the foods we sell come straight from Africa,” he said. “It (costs) a lot when we consider shipment from Africa to here. Getting your place was also a big deal because commercial buildings are very, very expensive.”

Mufano and his business partner were ultimately able to secure a loan and the store opened last year.

Without steady outside funding options, many businesses owned by people of color struggle to hire employees. Non-minority businesses are twice as likely to have multiple employees, the study said.

Edari said employees are the most expensive asset for any business. While she’s grown her business over the nearly eight years it’s been in operation, she said her 16-year-old son is her only year-round employee.

“We have seasonal people that come in to help package, but it’s just pretty much me doing everything,” she said. “In fact, I’m shocked that I can even do as much as I can do at 52, but I’m semi-automated and the automation has really helped. Being lean helped me survive the pandemic because I didn’t have to go through all the trauma of laying off a whole workforce.”

The study said it’s important to create inclusive business environments that provide communities of color opportunities to build wealth, social and economic mobility and community development.

In 2022, Gov. Tony Evers provided grant funding aimed at supporting diverse businesses. That March, he awarded $57.6 million to 24 chambers of commerce and nonprofit organizations providing assistance to small businesses. That August, he gave nonprofits another $15.7 million.

From her perspective, Edari said she wishes that money had gone directly to diverse businesses, rather than nonprofits.

“They funnel it through the nonprofit industry, and those tend to be private clubs where you have to pay a membership fee and they’re pretty high — sometimes it’s like $250 for the year, or even $100,” Edari said. “A lot of small Black businesses don’t have $100 to spend on a membership to something that really is not gonna have much value to them.”

Wisconsin Public Radio, © Copyright 2024, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.