Elgin Nelson

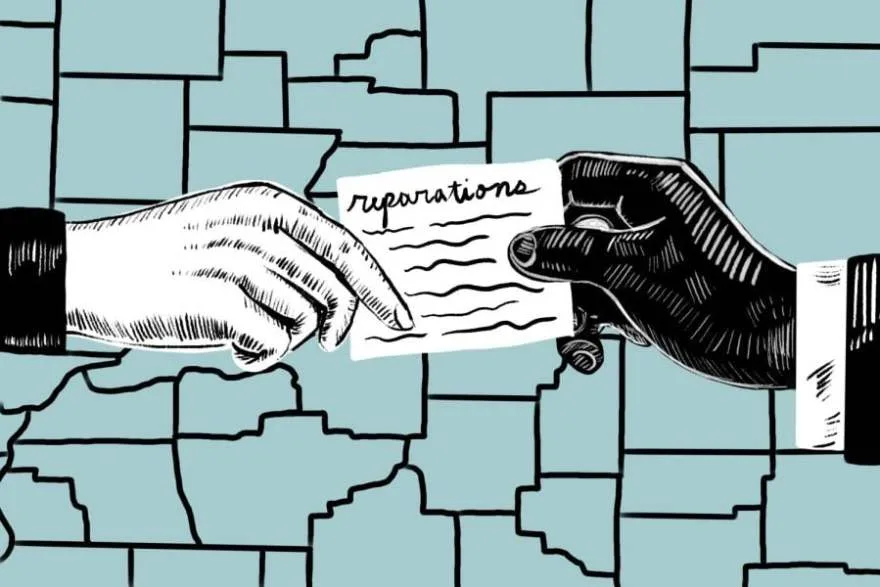

In the latest battle for reparations, Black activists have coined a new strategy in the form of huge tax breaks for African-Americans. The focus on tax breaks for blacks comes after momentum behind the reparations movement has started to halt. Tiffany Cross, former MSNBC host, called on activists in a recent podcast to pivot their frustrations for America’s flagging reparations efforts with this new initiative.

This also comes off the heels of Oscar-nominated actor Terrence Howard, who faced a nearly $1 million judgment in a federal tax case for unpaid taxes spanning several years. Despite reportedly not defending himself in court, transcripts of voicemails he allegedly left for the lead government attorney revealed his contention that it was ‘immoral’ to impose taxes on descendants of slaves.

He purportedly threatened to publicly shame the lawyer and asserted that he owed nothing to the government, as per court-filed transcripts of the alleged communication.

‘Four hundred years of forced labor and never receiving any compensation for it,’ the transcript reads. ‘Now you have the gall to try and prosecute and charge taxes to the descendants of a broken people that you are responsible for causing the breakage.’

Cross praised Howard, who was looking at the totality of ‘ancestral struggles’ of African Americans.

‘This brother was making a legitimate point,’ Cross said. ‘I don’t know how we would make this happen, but I would be completely down for some sort of policy that says ‘Yes, you are exempt from paying taxes.’

Last month, California’s black lawmakers introduced a set of bills addressing reparations for black residents, notably omitting the previously promised $1.2 million payouts. Now, activists are advocating for reparations to be provided in the form of tax breaks instead.

Reconstruction Era Reparations Act Now, an activist group based in Chicago, says property taxes should be waived for black residents as payback for the legacy of slavery.

“We have a problem, where our black citizens in Chicago are being kicked or forced out of Chicago, and they are going to the southern states to live comfortably,’ said the group’s founder Howard Ray Jr.

“Tax relief for blacks would be payback for the injustices of slavery, Jim Crow, racial lynchings, ‘redlining’ policies to restrict black homeownership, and the mass incarceration of blacks for drug offenses.”

Property taxes for a single-family home in Chicago and its suburbs typically range from $2,500 to $7,500 annually. The group’s objective is to present this issue to voters in a referendum during the November election.

Critics say payouts to selected black people will inevitably cause divisions between winners and losers, and raise questions about why other racial groups don’t get their own handouts. A survey last year of 6,000 registered California voters found that only 23 percent supported cash reparations, while 59 percent were opposed.

While many only associate direct cash payments with reparations, the true meaning of the word, to repair, involves much more,” said Assemblymember Lori Wilson.

Advocates encounter a challenging task in persuading other ethnic communities that reparations are warranted, partly due to their own experiences of racism and inequity. According to recent polls, a significant portion of Asian and Latino voters, who together constitute a majority of California’s electorate, as well as a majority of white residents, oppose reparations.

Newsom, closely monitoring this divide between various racial groups, continues to hold dialogue with Black activists in hopes to finalize a bill that would satisfy the long effort.

A spokesperson for Newsom said that the governor “continues to have productive conversations with the California Legislative Black Caucus. The governor is committed to further building upon California’s record of advancing justice, opportunity, and equity for Black Californians.”