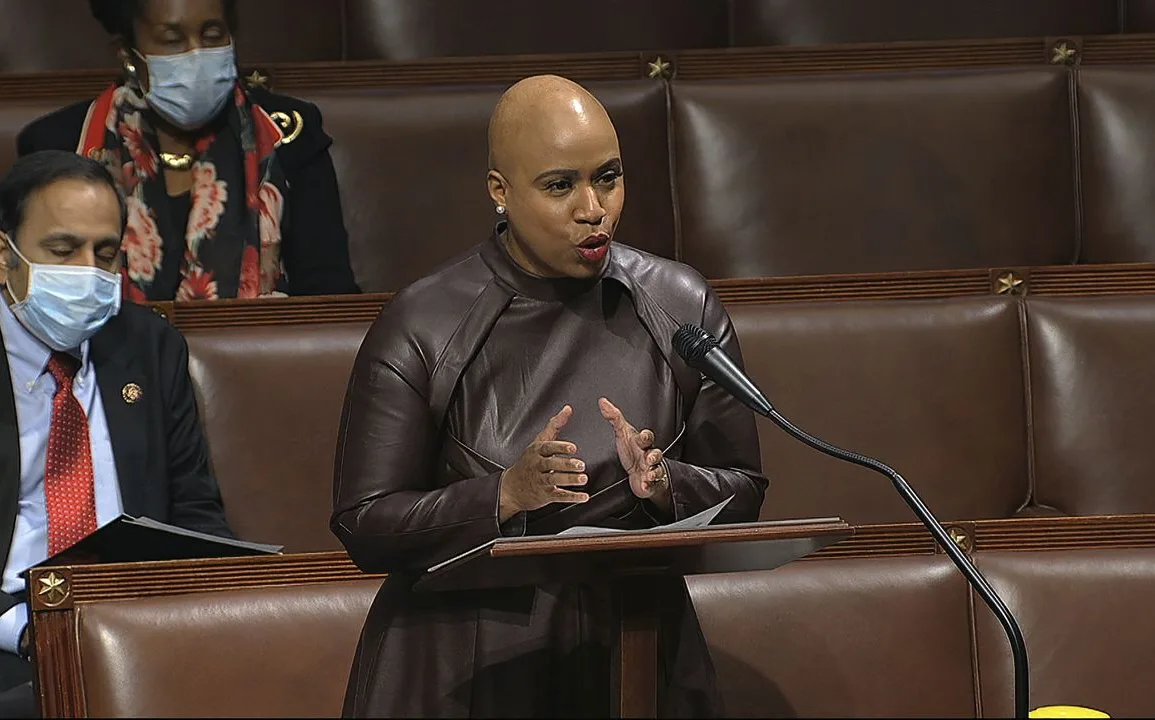

U.S. Rep. Ayanna Pressley, D-Mass., has called on the nation’s five largest banks to provide a detailed update on the billions of dollars they pledged to address racial and economic inequality following the murder of George Floyd in 2020.

In a letter sent Wednesday to the CEOs of JPMorgan Chase, Bank of America, U.S. Bank, Wells Fargo and Citi, Pressley requested that each of the financial conglomerates provide a financial report on the current status of their pledges by Oct. 23, 2023.

Specifically, she asked that the report include demographic and geographic data of recipients, policy changes to any financial services and future plans related to their pledges.

The U.S. House Democrat also requested that the banks describe any additional steps they’ll take to address racial disparities relating to access to credit, home loans, business loans and physical bank branches.

Of the five banks listed in Pressley’s letter, JP Morgan Chase, Bank of America and Citi were the only banks that responded to MassLive’s request for comment.

JP Morgan Chase pledged $30 billion over five years to support communities of color, which involved allocating funds to expand Black and Hispanic-owned businesses, as well as enhancing workforce diversity.

Last February, the bank said that it had already spent $13 billion of the money toward building 60,000 affordable homes and $1 billion on developing affordable housing units.

Bank of America, which made a $1 billion four-year pledge, said it committed earlier this year to an assessment of their pledge and look forward to sharing it when it’s complete. The last update the bank made was in March 2021 when they increased their pledge to $1.25 billion over five years.

Citi also made a $1 billion pledge but managed to exceed its financial commitment, the bank said in a September 2022 update.

Meanwhile, Wells Fargo and U.S. Bank pledged $450 million and $116 million respectively.

“As one of the five largest banks in the United States, it is critical your financial power is used to rectify the wrongdoing and heal the very communities harmed by the historical and contemporary role that institutions such as yours have played and continue to play in perpetuating racial inequities,” Pressley said in a statement.

For decades, bank lenders intentionally denied mortgages in Black neighborhoods – a policy known as redlining. Although the practice has been outlawed since the passage of the Fair Housing Act of 1968, many banks still employ their own “‘modern-day redlining,” according to Pressley.

According to a study from the National Bureau of Economic Research, African Americans who sought mortgages in 2019 were subject to higher interest rates than their white counterparts. They were also more likely to be denied loans that would have been granted to white applicants.

“In 1711, Wall Street established an official trading post of enslaved peoples and by the 1830s, big banks were following suit with a practice of selling ‘securitized slave bonds’ to investors,” said Jessica Church, Advocacy and Political Manager at Take On Wall Street. “From its inception, the financial industry has profited off racism and that legacy persists today.”

A member of the House Financial Services Committee, Pressley has been a leading voice in the fight to close the racial equity gap. She and Democratic U.S. Sen. Cory Booker, of New Jersey, reintroduced the American Opportunity Accounts Act in February 2023, which would create a federally-funded savings account of $1,000 at birth for every child.

The Democratic lawmakers say that the bill would help shrink the racial wealth gap between white and Black Americans.

Ahead of the 60th Anniversary of March on Washington, Pressley told the CEOs of the five banks that they, “play a key role in determining which individuals and communities have access to economic opportunity.”

“Your prior statements and pledge are welcome steps, but there needs to be greater transparency on the actions [your bank] has taken,” she continued.