HAMPTON — In the pit area of Langley Speedway, a racecar comes to a stop. Crystal West pulls herself out of the driver-side window, tosses off her jacket and begins changing one of her front tires. It’s Championship Night, Langley’s season-closing event that usually happens every October, and West is the lone female driver on the track.

Historically, Championship Night hasn’t been lucky for the 40-year-old mother of four, who started racing two years ago in what she describes as a “mom car,” with chicken nuggets and car seats in the back. In 2021, she wrecked her racer during the event. Last year, she got T-boned.

This year, her goal is for her car to stay in one piece — and maybe for it to give her enough points to finish the season in fifth place.

“It’s a lot of money invested in this,” she said, gesturing to the car. “It doesn’t look like it, but it’s a lot of money.”

West is part of a rich racing tradition in Virginia that dates back to 1904. That year, the state’s first documented automobile race took place on a horse track at Mariner’s Park in Norfolk. Since then, Virginia has spawned its fair share of notable racers, including Denny Hamlin, Curtis Turner, Ricky Rudd, Joe Weatherly, Jeff Burton, Ray Hendrick and Wendell Scott, the first African American driver and team owner to compete and win in all of NASCAR’s highest divisions.

But despite nearly 120 years of auto racing in the state, racing advocates say that Virginia’s speedways are still in need of a little help to stay competitive with other entertainment options like concerts, amusement parks and professional sports games. When COVID-19 emerged, it was the death knell for some racetracks and dragstrips around the nation that were already facing financial pressures from the need to pay for year-round upkeep from the proceeds of just a few dozen events a year. One example is Southside Speedway, a gritty 0.333-mile asphalt oval in Chesterfield County, which shuttered in 2020.

Now, at both the federal and local level, government officials are trying to support motorsports racing in Virginia. Earlier this year, U.S. Sen. Mark Warner, D-Virginia, introduced legislation to Congress that would create a permanent tax break for motorsports facilities. In Chesterfield, the county’s economic development authority is trying to save Southside Speedway by revamping the racetrack and developing adjacent property.

“It’s an important piece of Virginia’s economy,” Warner said.

From cattle to capital

When Connie Nyholm and Harvey Siegel first sought to rehabilitate Virginia International Raceway near Danville in 1998, there were cows grazing on the straightaway.

Originally in operation from 1957 to 1974, the track had literally been put out to pasture: The land had been leased to a farmer. But just two years after Nyholm and Siegel began their work, the “ghost track” was up and running again. It had also grown: VIR now boasts two small hotels, a restored 1840s tavern and an industrial park with 18 businesses.

The track itself offers five different configurations, of which two can be run simultaneously. For the past 15 years, it has also hosted Car and Driver’s Lightning Lap test of new high-performance cars, and the publication recently called VIR “arguably America’s most challenging race circuit this side of Germany’s Nürburgring.”

“We’re now a globally known and respected racecourse with … amenities that no other track in America has, and we started with a chewed-up piece of asphalt,” said Nyholm, co-owner and CEO of the raceway. “We’ve just been adding ever since we started. There have been very few days that we have not been under construction for some reason or another.”

Much of that work has been possible because of a temporary federal tax break. Since 2004, Congress has included a provision in the tax code that allows all assets within motorsports entertainment complexes to depreciate over a seven-year period rather than on longer 15- or 39-year timelines. Because the loss of value for tax purposes happens much more quickly than it otherwise would, businesses are able to deduct much larger amounts from their taxable income over the seven years, giving them more flexibility to use their funds as investments.

We started with a chewed-up piece of asphalt. We’ve just been adding ever since we started.

— Connie Nyholm, co-owner of Virginia International Raceway in Danville

However, Congress has never altered the tax break’s temporary status. Instead, Congress has periodically extended it, with the most recent extension set to expire at the end of 2025.

This year, Sen. Mark Warner has proposed making the benefit permanent through the Motorsports Fairness and Permanency Act, a change he says would encourage speedway owners to invest further in their tracks.

“We’ve had this patchwork tax treatment of motorsports for some time, and that is based on the depreciation schedule, which can radically change,” said Warner, who introduced the legislation with U.S. Sen. Todd Young, R-Indiana.

The legislation aims to offer businesses greater predictability in dealing with taxation and costs, he said.

“When you’re trying to make improvements on your track and suddenly you have a much, much longer depreciation schedule, the cost of making that improvement goes up dramatically, because you’ve got to write it off over a longer time rather than over the shorter term,” Warner explained. “If it expires, you would have a series of these tracks that have made assumptions based on this accelerated depreciation that might suddenly have all their financial assumptions thrown out.”

Unlike stadiums for most other types of sports, speedways are often privately owned, Nyholm noted, making the tax advantage particularly valuable.

“You’re relying on people like my partner and me and the bank to do all the financing and to be at risk for all the development and success of the business without any infrastructure help from the governing authority,” she said. “What the legislation does is encourage investment into motorsports facilities.”

Nyholm said the legislation, if passed, will help speedway owners big and small compete with similar entertainment draws. In its temporary form, she noted, the tax break has factored into practically every recent improvement she’s undertaken at Virginia International Raceway.

“Everybody’s trying to add amenities and up their game in comparison with their competitors,” Nyholm said. “We have been doing that over the years. The accelerated depreciation certainly makes that less painful and is very helpful to induce us to make those additional investments.”

Clay Campbell, president of Martinsville Speedway, said the tax break helps raceways stay relevant. Now 62, Campbell began working alongside most of his family at the raceway at the age of 10, and he’s seen racing evolve over the years. Started in 1947 by Campbell’s grandfather H. Clay Earles and Bill France Sr., co-founder of NASCAR, the Martinsville Speedway began with a dirt track carved out of red Virginia clay; today, it is the only original NASCAR track that’s still part of the circuit. Because of a railroad line on the course’s east side that limits its spread, the track maintains its original layout and shape.

“We have long straightaways, tight turns, and that creates excitement like none other,” Campbell said. “You go flying down these straightaways and have to slow down to make it through the turns. … It’s a lot of aggression that you’ll see here that you don’t see everywhere else. It’s been a fan favorite for 76-plus years.”

More than simply an entertainment facility, the Martinsville Speedway, said Campbell, has become synonymous with the city itself.

“We are a huge tax base for our area,” he said. “We employ a lot of people, and the recognition, you can’t match it any other way. The benefits to the community are astronomical, and we want to keep that going.”

Asked about Warner’s proposed legislation, Campbell pointed out that amusement parks already have this type of asset tax depreciation permanently on the books. He said the speedway has used the temporary tax break in the past for many projects, including a $5 million LED lighting upgrade at the facility in 2016.

If the legislation doesn’t pass, Campbell said he “would have to look at our business differently.”

“That doesn’t mean we’re shutting the doors,” he said, “but what we do every year would probably be reduced in some form or fashion.”

Saving the ‘toughest short track in the South’

Lin O’Neill wasn’t born at a racetrack, but he got to one as quickly as he could: He was 18 months old the first time he attended a race at Chesterfield’s Southside Speedway.

Growing up around the corner from Lennie Pond, the racer who was NASCAR’s 1973 Rookie of the Year and won Talladega in 1978, left an impression on him.

“He was like a second dad to me,” said O’Neill, who owns a lettering and sign company that often services racecars. “I always wanted to grow up and be like him. He was a very good guy.”

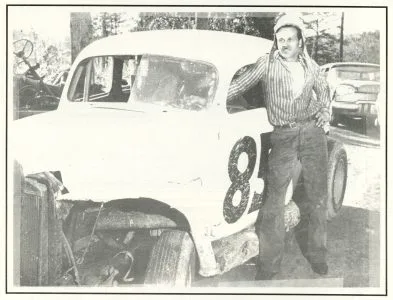

After a childhood spent going to races, O’Neill was shocked to hear in 1987 that there were plans to shutter the speedway and build a shopping center on the site. Worried that he wouldn’t ever race on his beloved track, O’Neill put $10,000 on two credit cards and built his first racecar. Luckily for him, the shopping center never came to be.

“I won three championships in a row,” said the 56-year-old, who recounted numerous members of the racing community letting him borrow the trailers, trucks and garages needed for transporting and storing a racecar over the years. “It took a village for me to get to the track.”

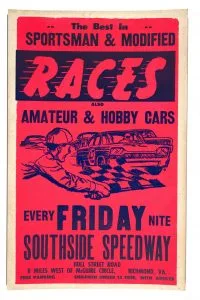

Nicknamed “The Toughest Short Track in the South,” Southside Speedway began its life in 1949 with so-called “midget” races on a dirt track. The moniker stems from its constraints: Space was at such a premium that cars routinely collided with each other and bounced off the walls. The raceway was part of NASCAR’s early circuit, boasting a lineage of drivers that included Richard Petty, Darrell Waltrip, Bobby Allison and Ray and Roy Hendrick. It’s also the place where Denny Hamlin, a Chesterfield native and three-time Daytona 500 winner, cut his teeth.

But all that stopped in 2020 when the speedway shuttered because of the pandemic. In June 2021, the Chesterfield Economic Development Authority purchased the 47-acre property for $4.5 million from a developer. Initially, it seemed like the area might be destined for more houses or amenities to complement the nearby River City Sportsplex, a complex of 12 athletic fields that the county lauds as a sports tourism draw.

After outcry from citizens, including O’Neill’s Save Southside Speedway campaign, the county began soliciting proposals to reopen the track. Earlier this year, officials put out a request for proposals to revive the entire 57-acre property; in September they broke the site into two entities, the 14.8-acre track complex and an adjacent parcel.

“It became very clear that the development community didn’t want to develop a sports facility, and that the racetrack community didn’t have a relationship with the developer community to go together to make one big RFP where they worked together,” said Garrett Hart, director of Chesterfield Economic Development. “We want to see the Southside Speedway property — the entirety of the property — develop in a way that enhances the experience of people visiting the area and people living in the area.”

Two letters of intent to purchase the land were submitted to operate the racetrack by the county’s Oct. 11 deadline: one from Avant–Garde Industries, LLC and one from O’Neill’s Competitive Racing Investments, LLC. Chesterfield’s Board of Supervisors has asked the Chesterfield EDA to review these proposals. Hart said there is no timeline for when a decision will be made.

“We have a good business model,” O’Neill said. “We’re not just doing a racetrack. We’re doing an entertainment center.”

Whatever happens, he wants the speedway back in operation.

“It’s a nonpartisan cause,” O’Neill said. “It’s not a Republican versus a Democrat. Everybody enjoys the place.”

As for Crystal West, the Langley Speedway racer who began her career with her “mom car,” she placed fifth in her Championship Night race and finished the season in sixth. By points, West actually tied for fifth place for the season, but because the other racer placed better on Championship Night, she was ranked sixth. West finished the previous season in 10th place.

“I went from 10 to six in one year,” she said, reached by phone after the race. “It’s a big accomplishment, but I’m pretty hard on myself, so I think I can do better.”

Though her car was smoking at the end of the race, it made it off the track in one piece.

“At least it didn’t happen during the race,” said West. “I have a foundation. I don’t have to start over from scratch.”

Virginia Mercury is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Virginia Mercury maintains editorial independence. Contact Editor Sarah Vogelsong for questions: info@virginiamercury.com. Follow Virginia Mercury on Facebook and Twitter.