Nearly four out of five owners of small- and mid-sized businesses anticipate revenue growth in the next 12 months, according to the 2024 Bank of America Women & Minority Business Owner Spotlight released today and published in partnership with Bank of America Institute.

The 78% level of confidence spans most business owners, with 76% of women, 82% of Hispanic-Latino, 84% of Black/African American, and 83% of Asian American and Pacific Islander, or AAPI, entrepreneurs anticipating revenue growth in the year ahead, the bank said in a news release.

Full survey results can be found here.

Results come from a survey of more than 2,000 owners of small and mid-size businesses across the country about their business outlook, access to capital, how they manage their employees, and how they interact with their community. The survey was conducted Aug. 7-21 and included small-business owners with annual revenue less than $5 million and employing two to 99 people, and mid-sized business owners with annual revenue between $5 million and $50 million and employing two to 499 people.

The annual survey samples a general population of the business owners and includes specific insights into the perspectives of women, Hispanic-Latino, Black/African American, and AAPI business owners.

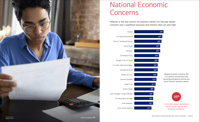

“Overall, it’s a good story, a lot of optimism with our business owners,” Raul Anaya, president and co-head of Business Banking for Bank of America, said in a web presentation on the report. “That doesn’t mean that there aren’t things that they are concerned about.”

That includes inflation at the top of the list, the political environment, presidential election, interest rates, and more. Drilling down, the report also finds owners concerned about hiring enough qualified labor.

Many business owners plan to hire and invest in employee education, including training and mentoring programs, as they prioritize labor and explore growth opportunities, Anaya said in today’s release.

Overall, 66% of the business owners believe the local economy will improve, 60% believe the national economy will improve, and 57% believe the global economy will improve, the bank said. The survey, though, indicates smaller employers are less optimistic, with 50% of small-business owners planning to expand and 39% planning to hire versus 78% and 61%, respectively, for owners of mid-sized businesses.

“Finding quality labor is one challenge facing many smaller firms, though employment growth is still strong, and our clients continue to be optimistic about staffing,” Sharon Miller, president and co-head of Business Banking for Bank of America, said in the release. “In the year ahead, they are looking to invest in their employees and utilize technology to bolster their hiring and improve client experiences.”

Other findings

Fifty-seven percent of women business owners plan to expand their business in the year ahead, the survey found, but 54% of women business owners increased their focus on work-life balance over the past year, the bank said.

“I know many of the respondents and many women clients that I talk to, it is about work-life balance, and it’s also about trade-offs and what do they have to prioritize for that given day, week, or month,” Miller said in the webinar, adding most women say that as their businesses expand, they want to leave a legacy for the next generation and make their communities better.

Hispanic-Latino business owners report strong confidence in the economy, including 78% who plan to expand their businesses over the coming year. However, 81% of owners surveyed said labor challenges are impacting their business. Some are having to raise wages to attract talent and work more hours personally due to staffing shortages.

Black/African American business owners are optimistic about their success in the year ahead and report strong business and economic outlooks, the release said, adding they’re prioritizing personalized customer interactions to attract and retain customers. Ninety-two percent are adjusting their marketing strategies and approaches, including more presence on social media and offering personalized deals and discounts to individual customers, the release added.

AAPI business owners also hold strong expectations for economic growth and success in the coming year, the bank noted. AAPI business owners also plan to seek capital and plan to improve their workforce stability in the year ahead, but 82% have reported challenges with the supply chain. Many also report inflation and labor challenges, and 60% plan to hire more employees over the next year and are taking steps to retain employees, Anaya said in the webinar.

For employers as a whole, the bank asked about technology and specifically artificial intelligence.

“It’s a topic that most business owners are trying to understand and really think about, How do they want to adapt AI to make things more efficient?” Anaya said, noting uses such as AI to help source and screen job candidates and leveraging AI for routine business operations.