Reparations activists have opened a new front in their battle for compensation for slavery-era abuses — huge tax breaks for black people.

Tiffany Cross, the author and television host, and other presenters of her Native Land Pod, this week tried to reboot America’s flagging reparations efforts with a call for tax breaks for African Americans.

Campaigners have already erected billboards to this end in Chicago, pushing for black-only carve-outs on the $6,000-a-year property taxes that are typical in the Illinois city.

They also spotlight Empire star Terrence Howard, who was recently outed for refusing to pay years’ worth of income dues as he felt it was ‘immoral’ to tax the descendants of slaves.

Cross, a former MSNBC host, praised Howard in her podcast, which looks at the ‘ancestral struggles’ of African Americans.

‘This brother was making a legitimate point,’ Cross said.

‘I don’t know how we would make this happen, but I would be completely down for some sort of policy that says ‘Yes, you are exempt from paying taxes’.’

According to Cross, black labor on Southern plantations made America the ‘superpower’ it is today, but the descendants of those slaves have ‘never been repaid … we built this joint for free.’

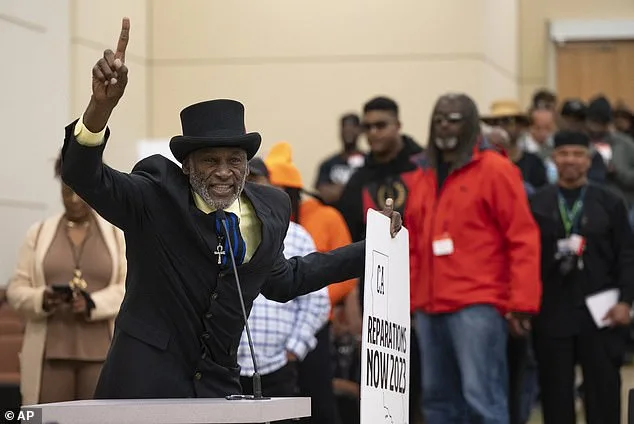

The focus on tax breaks for blacks comes after momentum behind the reparations movement has started to flag.

After the police killing of George Floyd in May 2020 and the Black Lives Matter protests, cities and states across the country launched task forces to tackle modern-day inequality rooted in the slavery era.

But early calls for multi-million dollar payouts to the descendants of slaves have fizzled out — as politicians realized they were unpopular among the whites, Asian and others who would foot the bill.

California’s black lawmakers last month unveiled a package of bills on reparations for black residents that makes no mention of the $1.2 million payouts they were promised earlier.

Now, Cross and others seek a payout through tax breaks instead.

US state and federal taxes are assessed by income, not an individual’s race.

Cross suggested that tax chiefs lower income taxes for those descended from slaves.

‘If you’re in this tax bracket, if you are a descendant of the enslaved, then we will decrease your tax bracket,’ she said.

Cross did not tackle the long-standing concerns about reparations, such as assessing who qualifies, and why Native Americans and others with historical grievances don’t get their own payout schemes.

Activists in Chicago are pushing their own specific version of tax-break reparations.

Reconstruction Era Reparations Act Now, or RERAN, says property taxes should be waived for black residents as payback for the legacy of slavery.

‘We have a problem, where our black citizens in Chicago are being kicked or forced out of Chicago, and they are going to the southern states to live comfortably,’ said the group’s founder Howard Ray Jr.

Tax relief for blacks would be payback for the injustices of slavery, Jim Crow, racial lynchings, ‘redlining’ policies to restrict black homeownership, and the mass incarceration of blacks for drug offenses, he says.

The group aims to put the issue to voters in a referendum in the election in November.

Property taxes on a single-family home in Chicago and its suburbs average between $2,500 to $7,500 each year, according to the property website Virtuance.

Taxes have jumped up in recent years, straining budgets in poorer households.

RERAN says they will use census data to track descendants of slaves who would qualify, regardless of their income.

Cross and her podcast co-hosts were inspired by another tax carve-out — the apparent refusal to pay dues by Howard, the 54-year-old Empire star.

The Oscar nominee was hit last month with a nearly $1 million judgment in a federal tax case over years worth of unpaid taxes.

Although he reportedly didn’t defend himself in court, the government presented transcripts of voicemails he allegedly left the lead government attorney in which he said it was ‘immoral’ to levy taxes against descendants of slaves.

He reportedly threatened to embarrass the lawyer by posting about the case online, and he claimed he owed nothing to the government, according to a transcript of the alleged call that was filed in court.

‘Four hundred years of forced labor and never receiving any compensation for it,’ the transcript reads.

‘Now you have the gall to try and prosecute and charge taxes to the descendants of a broken people that you are responsible for causing the breakage.’

Reparations campaigners say it’s time for America to repay its black residents for the injustices of the historic Transatlantic slave trade, Jim Crow segregation and inequalities that persist to this day.

The sums are eye-watering — black lawmakers in Washington seek at least $14 trillion for a federal scheme to ‘eliminate the racial wealth gap’ between black and white Americans.

Critics say payouts to selected black people will inevitably stoke divisions between winners and losers, and raise questions about why American Indians and others don’t get their own handouts.

While reparations are popular among blacks, the other groups who would foot the tax bill are less keen.

A survey last year of 6,000 registered California voters found that only 23 percent supported cash reparations, while 59 percent were opposed.