Nov 24 (Reuters) – U.S. stocks were subdued on Friday in a shortened trading session for Thanksgiving, while investors focused on retailers to assess consumer health as Black Friday sales kicked off amid signs of slowing economic conditions.

The main three U.S. stock indexes were still set for their fourth consecutive weekly gains, driven by hopes that the Federal Reserve is done hiking interest rates and signs the U.S. economy remains resilient.

The benchmark S&P 500 (.SPX) is about 1% away from setting a new high for the year.

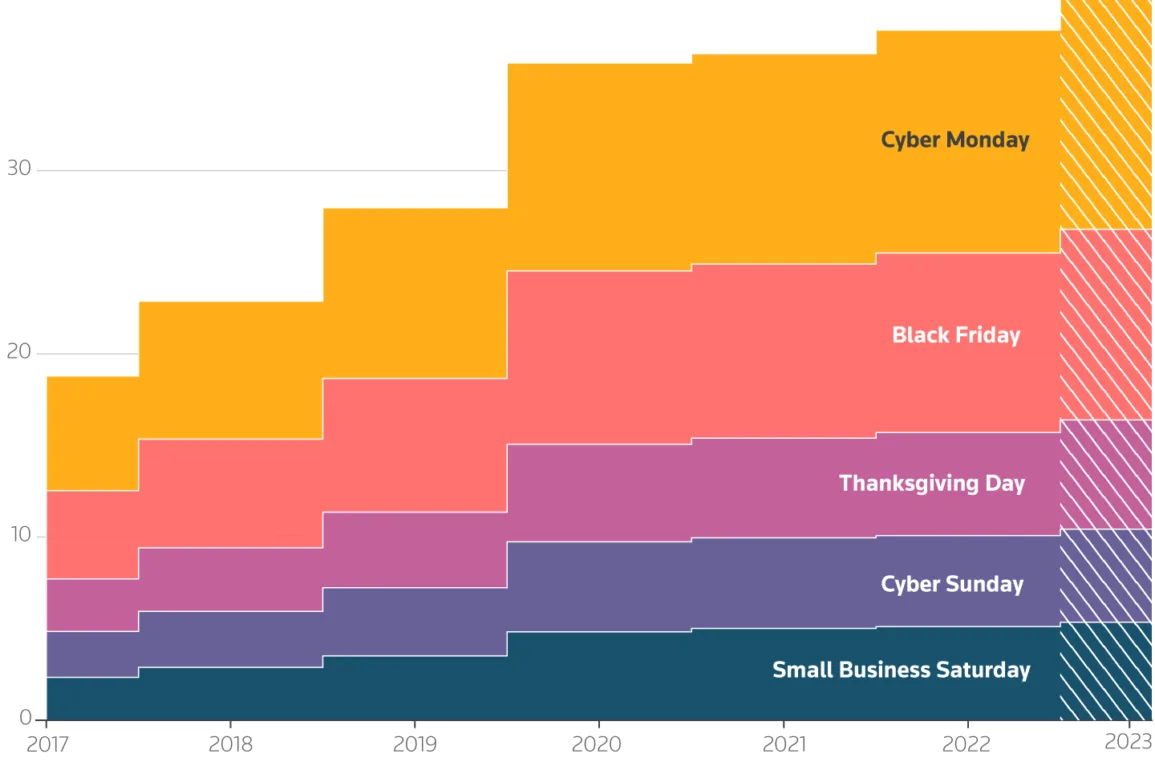

Focus will be on retailers preparing for what they hope will be yet another record-setting global shopping spree on Black Friday, which usually marks the unofficial start of the Christmas shopping season.

“The drop in oil prices and the decline in inflation both increase purchasing power for consumers, which bodes very well for retailers,” said Greg Bassuk, chief executive officer of AXS Investments in New York.

“Greater consumer spending and a strong earning season is going to be a strong foundation to reverse some of that retailer cautionary sentiment that we heard in the recent earnings report.”

The S&P 500 retail sector (.SPXRT) sub-index was, however, down 0.4%.

U.S. stock markets were shut on Thursday for the Thanksgiving holiday, and Friday’s session ends at 1:00 p.m. ET. The market ended higher on Wednesday after reports on jobless claims, durable goods, and consumer sentiment seemed to suggest the economy is easing but may stay strong enough to avoid a recession.

Traders digested the S&P Global’s flash U.S. Composite Purchasing Managers Index (PMI), which showed factory and services sector activity held steady in November.

At 9:50 a.m. ET, the Dow Jones Industrial Average (.DJI) was up 66.60 points, or 0.19%, at 35,339.63, the S&P 500 (.SPX) was down 2.05 points, or 0.04%, at 4,554.57, and the Nasdaq Composite (.IXIC) was down 34.41 points, or 0.24%, at 14,231.45.

Among single stocks, Nvidia (NVDA.O) fell 1.1% after Reuters reported the chipmaker told customers in China it was delaying the launch of a new artificial intelligence chip to comply with U.S. export rules until the first quarter of next year.

iRobot (IRBT.O) rallied 30.1% following a report that Amazon (AMZN.O) is set to win unconditional EU antitrust approval for its $1.4 billion acquisition of the robot vacuum maker.

Vista Outdoor(VSTO.N) added 4.8% after Czech gunmaker Colt CZ Group (CZG.PR) made a nearly $1.7 billion cash-and-stock merger offer to the sporting and outdoor goods group on Thursday.

U.S.-listed shares of Chinese EV maker Xpeng rose 4.9% after Volkswagen (VOWG_p.DE) said it will develop a new platform for entry-level electric vehicles in China.

Advancing issues outnumbered decliners by a 1.61-to-1 ratio on the NYSE and by a 1.54-to-1 ratio on the Nasdaq.

The S&P index recorded 16 new 52-week highs and no new low, while the Nasdaq recorded 37 new highs and 29 new lows.

Reporting by Sruthi Shankar and Shristi Achar A in Bengaluru; Editing by Maju Samuel

Our Standards: The Thomson Reuters Trust Principles.