These Key Findings are based on a dataset downloaded on July 31, 2023 from CEO Succession Practices in the Russell 3000 and S&P 500: Live Dashboard. The Live Dashboard is updated weekly with information on succession announcements about chief executive officers (CEOs) made at Russell 3000 and S&P 500 companies; please browse the Live Dashboard to review and download the most current figures. For comparative purposes, the Live Dashboard includes historical data and breakdowns across business sectors (as classified under the Global Industry Classification Standard, or GICS) and company size groups; see Using This Dashboard for more details. In the coming weeks, these Key Findings will be complemented with a series of insights for members of The Conference Board.

The project is conducted by The Conference Board and ESG data analytics firm ESGAUGE, in collaboration with executive search firm Heidrick & Struggles.

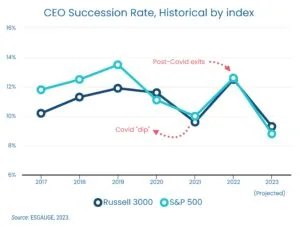

In 2022, the CEO succession rate at US public companies rebounded after the Covid dip of 2021—a finding that could be explained by the higher number of exits of retirement-age CEOs (including those who, during the pandemic, had agreed to postpone their retirement to ensure leadership continuity to their organization). Boards planning CEO successions should be aware of the implications that the recent exodus may have on the competitiveness of the job market for top leadership talent.

The 2022 CEO succession rates were 12.5 percent in the Russell 3000 (compared to a historical average of 10.9 percent) and 12.6 percent in the S&P 500 (compared to 11.1 percent historically). The rates are expected to normalize this year, and possibly soften below the historical average, with current 2023 projections of 9.3 percent in the Russell 3000 and 8.8 percent in the S&P 500. (Strong profits and a competitive labor market, balanced by geopolitical uncertainties and lingering recession concerns, are among the factors that may contribute to the 2023 succession forecasts, which would need to be confirmed later this year.)

Similarly, the 2022 CEO succession rates among CEOs aged 64 or older were 26.1 percent in the Russell 3000 (compared to a historical average of 21.1 percent) and 31.8 percent in the S&P 500 (compared to 26.7 percent historically). For 2023, we currently project them at 18.7 percent in the Russell 3000 and 21.9 percent in the S&P 500, based on data from the first seven months of 2023.

Even better-performing companies experienced higher-than-average CEO exits in 2022. In the Russell 3000, companies with an annualized total shareholder return (TSR) in the top-three index quartiles reported a CEO succession rate of 10.4 percent, compared to a five-year average of 9.2 percent. In the S&P 500, 10.9 percent of top performers announced their CEO departures in the same year, compared to a 20+ year average of 9.7 percent. These figures are projected to decline in 2023 to 8.1 percent and 6.7 percent, respectively.

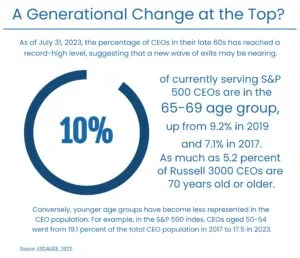

Data on sitting CEOs by age and tenure show a growing group of top leaders whose retirement may be imminent. As of July 31, 2023, 10 percent of currently serving CEOs in the S&P 500 are in the 65-69 years-of-age group, up from 9.2 percent in 2019 and 7.1 percent in 2017. As much as 5.2 percent of Russell 3000 CEOs are 70 years old or older. Conversely, younger age groups have become less represented in the CEO population: For example, among the larger companies of the S&P 500 index, CEOs aged 50 thru 54 went from 19.1 percent of the total CEO population in 2017 to 17.5 in 2023; and those in the 55-59 years-of-age group declined from 35.1 percent to 32.7 percent.

The increasing percentage of chief executives who remain in their job past a typical retirement age suggests that a new wave of CEO exits may be nearing. Boards should consider these individuals’ wealth of knowledge and experience and proactively plan CEO succession to avoid leadership gaps and ensure a smooth transition. Directors should also recognize that this generational change results in career advancement opportunities for younger executives from underrepresented groups who can improve the diversity and dynamism of leadership teams.

Data on tenure also supports this analysis. The percentage of CEOs with tenure of 12 thru 14 years and the percentage of CEOs with tenure of 15 years or longer have grown (in the S&P 500, respectively, from 3.9 percent in 2017 to 4.7 percent in 2023 and from 9.7 percent in 2017 to 11 percent in 2023). The highest percentages of CEOs in these long-tenure groups are in the Financial Services sector (with 10.6 percent of Russell 3000 CEOs with tenure of 12 years or more but less than 15 years and 19.8 percent of CEOs with tenure of 15 years or longer) and the Information Technology sector (with as much as 20.6 percent of its currently serving CEOs who have been in their role for 15 years or longer).

The rate of “forced” CEO successions (which we define as successions involving younger-than-retirement age CEOs at firms performing in the bottom quartile of their industry peers) rebounded in

This data suggests that the business landscape may be starting to normalize after the anomalies of the Covid years, when many companies chose to ease certain performance metrics and avoid the unnecessary risks resulting from a leadership transition during a crisis. Forced CEO successions usually follow poor performance or other leadership shortcomings, and they can be attributed to governance failures, including inadequate oversight and risk management practices. Boards should establish robust performance evaluation and other oversight mechanisms for their CEOs, including periodic independent evaluations, to promptly identify areas of improvement and minimize the likelihood and disruptions of unplanned leadership transitions.

Given their link to performance, trends on CEO dismissals may vary greatly across industries and are highly dependent on market circumstances. In 2022, according to the business sector analysis of the Russell 3000 index, boards in the Communication Services and Consumer Staples sectors reported forced succession rates much higher than the index’s historical averages (21.4 percent and 18.8 percent, respectively, compared to an index average over the years of 8.9 percent).

Among Russell 3,000 companies, the appointment of women CEOs reached a record high in 2022: 45 CEOs (or 12.1 percent of successions in 2021), continuing the upward trajectory from when TCB and ESGUAGE began tracking this statistic in 2017. The S&P 500 reveals a similar trend, with incoming women CEOs reaching 17.5 percent of successions, nearly eclipsing the record high of 18.2 percent in 2011 and more than double the 23-year rate of 6.8 percent.

The lack of women in the C-suite has been a focus of corporate governance commentators for many years. While the representation of female CEOs continues to grow, only 6.6 percent of sitting CEOs at Russell 3000 companies and 7.8 percent of sitting CEOs at S&P 500 companies are women. In 2017, these percentages were 4.5 and 5.5, respectively. In 2022, the net change in the number of female CEOs (i.e., incoming female CEOs minus departing female CEOs) was the highest ever recorded by The Conference Board and ESGAUGE in the two indexes. More specifically, after accounting for female departures, the Russell 3000 index added 18 female CEOs in 2022 alone, and the S&P 500 added nine.

The progress seen in the number of incoming women CEOs is encouraging, albeit with substantial room for further growth: This is confirmed by preliminary figures for 2023: As of July 31, while the number of female CEO appointments in the Russell 3000 (20, or 12.3 percent of the total cases of CEO succession announced this year) is in line with the 2022 finding, only one of the 26 new CEOs named at S&P 500 company is a woman.

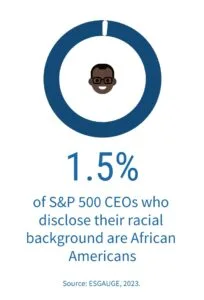

The disclosure of sitting CEOs’ race and ethnicity reached a record high in 2023: 27.6 percent of S&P

According to the Russell 3000 analysis by industry of companies that provided CEO race/ethnicity disclosure, several business sectors have no African American CEO (the highest representation is in the Consumer Staples sector, with 6.7 percent of the CEOs for which ethnicity information is provided who state that they are African American). Consumer Staples and Utilities have the highest representation of Latino or Hispanic CEOs (13.3 percent and 12.5 percent, respectively, of the CEOs of companies from those sectors that provided the disclosure this year), while Energy and Information Technology have the highest percentages of Latino or Hispanic CEOs (21.4 percent and 14.3 percent, respectively, of the CEOs of companies from those sectors that provided the disclosure this year).

According to our full 2022 database of S&P 500 companies disclosing the race and ethnicity of the incoming CEO after a CEO succession event last year, 14.3 percent announced the appointment of an African American CEO, and 14.3 percent announced the appointment of a CEO of Asian, Hawaiian, or Pacific Islander origin; none disclosed the appointment of a Latino or Hispanic CEO. But the percentage of appointments where the race or ethnicity of the incoming CEO is not disclosed remains high (88.9 percent of successions in 2022). Companies are increasingly committing to diversity and inclusion, including in the senior leadership team. Disclosing the race and ethnicity of sitting and incoming CEOs is essential to continue enhancing transparency around the underrepresentation of minorities in the C-suite. It can also be a positive example for other companies, influencing broader societal perceptions of representation and opportunities in business organizations.

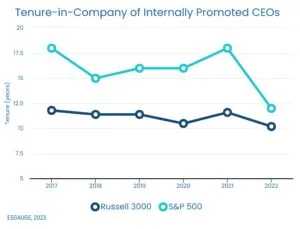

The rate of inside promotions to the CEO position in the Russell 3000 increased from the prior years, reaching 73.5 percent of incoming CEOs in 2022—the highest since The Conference Board and ESGAUGE began tracking these statistics. In the S&P 500, the rate of inside promotions is projected at 84.6 percent for 2023, one of the highest ever recorded and higher than the historical average

While a critical source of CEO talent continues to be long-serving executives promoted from within, data suggests that after the pandemic, boards fast-tracked inside promotions to the chief executive post. As of the end of 2022, the average tenure-in-company of internally promoted CEOs was 12 years in the S&P 500 and 10 years in the Russell 3000, lower than the historical averages of 16 years and 11 years, respectively. The share of “seasoned executives”—or those with at least 20 years of company service—was also lower t

These statistics also vary significantly across business sectors. In 2022, 47 out of 68 newly appointed CEOs in the Health Care sector were internal promotions, and their average tenure with the company was only 5.3 years. It was the shortest tenure-in-company for internally promoted CEOs observed across sectors, followed by Energy and Consumer Discretionary (8.7 years in both cases). On the other end of the spectrum, in Utilities, it took incoming inside CEOs an average of 15.2 years to be promoted to the chief executive role.

The exodus of retirement-age CEOs and the higher succession rates recorded last year, combined with a competitive job market, may help to explain these findings. But it is also worth considering other factors and changing perceptions of leadership. Agility and adaptability in corporate leadership have become imperative amid increasingly unpredictable business environments, shifting customer demands, and the rapid pace of technological advancements. This data may also indicate that companies are departing from a more traditional approach to CEO succession planning to embrace new leadership traits. While designing a transition strategy and recruiting new chief executives, boards may want to consider looking for leaders willing to abandon tested business models to favor innovation, experimentation, and openness to ongoing changes.

The decline of tenure-in-company and “seasoned executives” in a year where the overall rate of CEO succession increased may also suggest that companies accelerated their leadership development process to expand their pool of CEO candidates. To help mitigate human capital risks, the entire board should review, at least annually, the leadership development process within their companies and scrutinize internal succession candidate lists.